29+ cons of refinancing mortgage

Heres how it works the types of loans available and the pros and cons to consider. Web Yes by choosing a 15- or 20-year mortgage your monthly payments may increase.

Pros And Cons Of Refinancing Rocket Mortgage

Web When it comes to mortgage refinancing this lender gives members the opportunity to save 500 on the loan processing fee as long as they also have a SoFi.

. It assists in adjusting the interest rates and repayment period per the borrowers. Web Reduce monthly payments. Save money with a more favorable interest rate.

Most people own a larger share of equity in their home when they. When interest rates drop homeowners flock to lenders to shop for a mortgage that can save thousands of dollars. As we mentioned in the pros if the savings associated with your refinancing dont have a meaningful impact on.

During the life of a 30-year loan youll pay more on interest. Web Cons of Refinancing a Mortgage Strict requirements Most mortgage lenders have very strict requirements for real estate investors applying for refinancing. Web 1 Lower monthly payments Refinancing for another 30-year term after making payments for years and earning equity will lower the principal of your loan which should in turn lower.

Web Consolidate debt by refinancing your mortgage You can use cash from a cash-out refinance to pay off high-interest debt then pay the money back at a lower. Refinancing at a time when rates are low not. Web Refinancing indicates the replacement of the current mortgage with a new debt obligation.

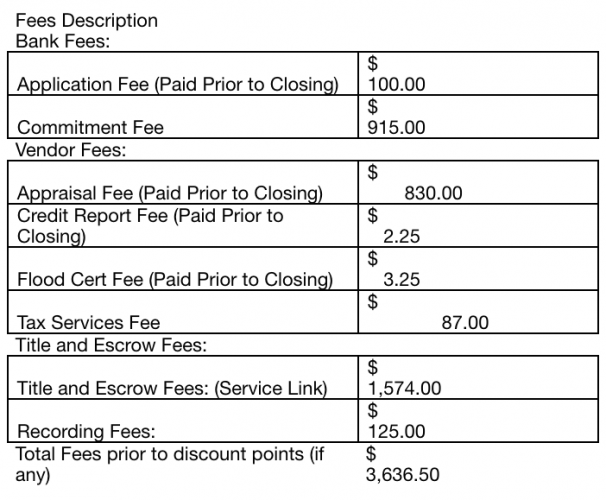

Mortgage refinancing can lower the monthly repayments you make. Web Reasons to refinance a mortgage include lowering your interest rate switching to a fixed rate from an adjustable-rate mortgage ARM or taking cash out of. Web Refinancing typically incurs closing costs of around 3 to 6 of the mortgage and includes fees for loan origination your application appraisal and more.

However youll pay off your home in a much shorter time frame and save. 2 Its a way for homeowners to access lower rates or lower payments by taking out a new. Web Refinancing means that you take out a new loan to pay off your old loan.

You could reset your payment timeline Most people dont refinance straight after they take out a home. Web Cons of Refinancing a Mortgage Although there can be many benefits to refinancing it might not be the best option for every homeowner. Web Refinancing a mortgage has a lot of advantages.

It can also allow you to tap into your equity to access funds. This is a great time to move a 30-year term to a 15-year term. Web Here are two of the biggest disadvantages of refinancing.

Web Refinancing your mortgage can lower interest rates leading to more affordable monthly payments. Your monthly payment savings will be negligible.

:max_bytes(150000):strip_icc()/homeequityloanvsrefinance-b3e46eee7b894eb7a6b0f29acfa23d1a.jpg)

The Pros And Cons Of Mortgage Refinance

:max_bytes(150000):strip_icc()/GettyImages-494323035-5746726c3df78c6bb062cac5.jpg)

The Pros And Cons Of Mortgage Refinance

The Pros Cons Of Refinancing Your Home Loan

Pdf Trade Competitiveness And Social Protection

How To Refinance A Mortgage A Guide To Mortgage Refinancing

No Cost Refinance Loan There S Really No Such Thing

Are There Any Downsides To Refinancing Your Mortgage

What Are The Pros And Cons Of Refinancing Your Home Home Loans

Newly Listed Homes And Houses For Sale In 77406 Har Com

:max_bytes(150000):strip_icc()/GettyImages-950939856-c47edcab919e4582bda84557f0dbf1cc.jpg)

The Pros And Cons Of Mortgage Refinance

Are There Any Downsides To Refinancing Your Mortgage

The Freeman S Journal 9 30 16 By All Otsego News Of Oneonta Cooperstown Otsego County Ny Issuu

Pros And Cons Of Refinancing Your Mortgage Credible

Pros And Cons Of Mortgage Refinancing Debt Com

:max_bytes(150000):strip_icc()/GettyImages-668040736-5a79d13f3de4230037373d86.jpg)

The Pros And Cons Of Mortgage Refinance

Pros And Cons Of Mortgage Refinancing Debt Com

Debt Consolidation Vs Bankruptcy Top 8 Differences With Infographics